Many people go around in circles as they spend so much time worrying about their savings and investments and swim around daily on Google in search on things which matter so litter such as “which is the best stock to invest in” or “which mutual fund should I invest my money in” or “ which policy gives the highest returns”. Ironically, while doing so, they are wasting their time in so many months and years in small installments that they are not even realized of it later. I sometimes wonder that how their long-term financial goals would achieve on such their unproductive action. When people realize or rather confronted with the fact that they have been lost their precious time and opportunities in long-term thinking process which might have create magic in their financial life through time and compounding, their financial life has gone in a deep mess. Hence, you must agree that the money you invest early in your life has drastic effect on the money you accumulate over the years. It would be always true, if we think in long-term investing but we hate the term ‘long-term’ and get impatient on returns. But remember, in the parlance of investment world, if there is no “long-term”, there is no time for “compounding”. Time is a great reward and everyone has a good opportunity of it. If you miss the time at the start, you lose your handsome reward and wealth accumulating.

Indeed, the powerful link between time and reward is often described as the “magic of compounding.” The longer the time horizon, the greater the power of compounding investment returns in transforming an initial outright investment, or a series of modest annual investments, into a truly breathtaking final value.

Let’s begin with two basic cases of the magic of compounding.

Lump-sum Single Initial Investment

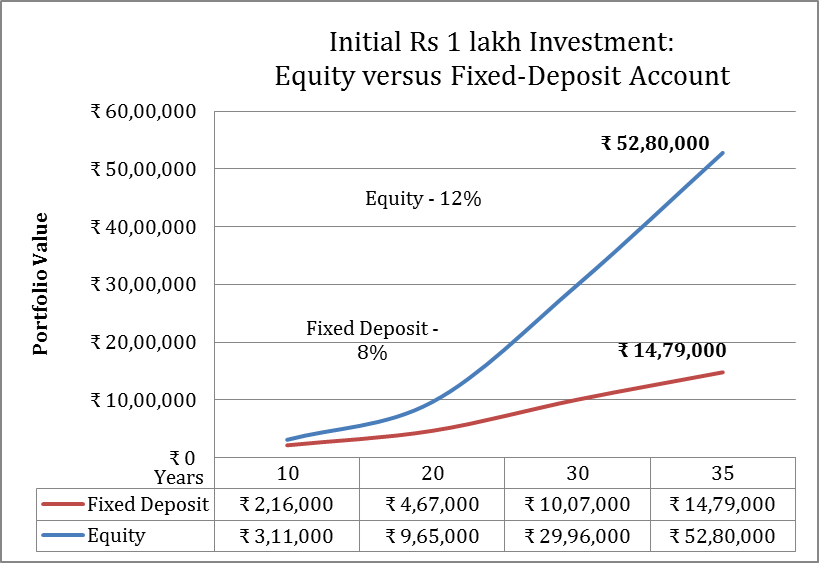

It is a typical mutual fund industry format for comparing the result of an initial investment of Rs 1 lakh in equity which will be staying invested for a working life time of 35 years while earning an equity average return of 12 percent annually with a fixed deposit in banks alternative that is earning the much lower annual return of 8 percent.

The investment in equity builds its reward over fixed-income year after year. Above chart shows how this edge in reward grows over the decades. The returns on equity produce a final reward of Rs. 52.80 lakh; the returns on fixed deposit produce a final reward of Rs. 14.79 lakh. Magic is hardly too strong a word for this awesome differential.

The Power of Compounding

Suppose you are 35 years old and expect to retire at age 60, your goal is to invest regularly and accumulate Rs 2 crore for your retirement fund while using the same assumptions as outlined above.

| Cumulative Monthly Investment | Final Value* | ||||

| Number of Years | Equity SIP | Recurring Deposits | Equity SIP | Recurring Deposits | |

| 10 | ₹ 14,10,000 | ₹ 25,29,000 | ₹ 26,33,000 | ₹ 38,70,000 | |

| 15 | 21,15,000 | 37,93,000 | 55,92,000 | 73,06,000 | |

| 20 | 28,20,000 | 50,58,000 | 1,08,08,000 | 1,24,13,000 | |

| 25 | 35,25,000 | 63,22,000 | 2,00,00,000 | 2,00,00,000 | |

| *Assumed rates of return : Equity, 12 percent; Recurring Deposits, 8% | |||||

Using the above table, you will be able to generate Rs 2 crore in 25 years, if you invest in monthly equity SIP worth Rs 11,750 while assuming a return of 12 percent and your investment tenure is 25 years. If you want to invest in recurring deposit which gives a return of 8%, you would have to invest monthly Rs 21,071. This seems like the most intuitive way to formulate investment progresses. In a nutshell, if you look closer at 20th year, you will see that your equity investment has been grown just Rs 1.08 crore, which is just 54% of the final corpus. In the just next five year, your investment corpus gets accumulate amass Rs 2 crore, which is the almost double of accumulated amount of Rs 1.08 crore at the end of 20th tenure provided you remain continue to invest your money to grow for the interim just 5 years. If you are conservative investor, early investing is more than necessary… its critical. You should see early investing as a “strategy” rather than a “fact” for your investment.

The Rule of 72

The Rule of 72 provides a wonderful illustration of the magic of compounding. To quickly approximate how many years are required to double the value of an investment, you simply divide the rate of return into 72: a 4 percent return takes about 18 years; 6 percent, 12 years; 10 percent, 7 plus years; and so on.

The following table shows how quickly money grows over various time periods at various rates. Note how the reward of higher return increases over time. At 4 percent, it takes 72 years—a very long time horizon—for the original investment to multiply 16-fold. But at 12 percent, it takes 24 years, only one-third the time, to grow 16-fold. After some 30 years, the investment compounding at 12 percent annually multiplies 32 times over, a multiple that the 4 percent rate would not reach until 90 years had elapsed.

Using the Rule of 72

Compound

Rate 2 Times 4 Times 8 Times 16 Times 32 Times

4% 18 years 36 years 54 years 72 years 90 years

6 12 24 36 48 60

8 9 18 27 36 45

10 7 14 21 28 35

12 6 12 18 24 30

The Rule of 72 also works in another useful way for investors putting money away today so that you can receive income tomorrow. For any given rate of return, the Rule of 72 shows how many years you must regularly invest a given sum before you can stop investing and then start withdrawing the same amount without depleting your capital.

For example, if you invest Rs 500 per month at an 8 percent rate of return, after 9 years (72 divided by 8) you could regularly withdraw Rs 500 per month and still leave your principal untouched. After 18 years, you could begin to make withdrawals of Rs1,500 per month. After 27 years, you could withdraw Rs 3,500 per month, and still preserve principal. But if your rate of return were 12 percent, your waiting time would be shorter: six years to begin Rs 500 monthly withdrawals, 12 years for Rs 1,500, and 18 years for Rs 3,500. After 24 years, you could withdraw Rs 7,500 per month without impairing your principal—fully five times the amount possible at the 8 percent rate of return.

Final Thoughts

By now you must be suitable impressed with all the magic that you make at the beginning get sufficient time to grow and compound drastically over the years. We should understand that it is not a magic, it is purely mathematics and compounding whether you lose the last 10 years or 15 years, one thing remains certain, you have put in enough effort in the start and then given sufficient time to your investment to grow. The whole idea is to motivate you into early investing and show you what it can do for your financial life. So, don’t lose time as 5 years wasted in the start is worse than wasting 15-20 years towards the end of your earning life. But the message, time is your friend always remains.

Suresh Kumar Narula is founder and Principal Financial Planner at Prudent Financial Planners. He has earned the professional CERITIFIED FINANCIAL PLANNER and got registered with SEBI as Investment Advisor. He writes on personal and financial planning articles and got published in Dainik Bhaskar, Business Bhaskar and The Financial Planner’s Guild, India. He is also a member of Financial Planner’s Guild India ( An association of practicing SEBI registered Investment advisers) to create awareness about Financial Planning in general public, promote professional excellence and ensure high quality practice standards. Suresh received his an M.com from Himachal Pardesh University and an MFC from Punjab University, Chandigarh. He can be reached at info@prudentfp.in