As financial planners, we believe in real returns (%), but people have their own strong numbers and also have their own perceptions about property investments. They don’t readily want to believe and compare with equity funds because they never look at them as an investment asset. They perceive that ‘Equities are volatile and Risky’ and Property investment has no downside risk. Though they may be right to some extent, they have limited knowledge and a limited number of examples. Perhaps, they are probably looking only at the last few years of good times and not at the entire cycle. Equities are undoubtedly more volatile but people are short-sighted and feel as if it’s quick way to make money. They are weirdly with property prices which would never fall and get the highest return among all asset class. And guess what, how many times has the property prices appreciated on an average across India in last 18 years? Mostly they have appreciated in the range of 6 to 10 times and in very few cases slightly more. Any idea how many times has money multiplied in Equity MFs in last 18 years? Unbelievable, it has multiplied in the range of 20 to 82 times of your original investments. The real conflict of returns between two assets starts here and this post will break your myth about property investments through our clearly transparent approach with facts and figures.

Courtesy : freedigitalphotos.net

Let’s allow putting in considerable effort to showcase hard data over various time periods and crack the code of illusion among property investors.

History of World’s Rich Famous Investors

Can you give me names of World’s Richest and famous Property Investors, barring Builders and developers? Most probably you would not be able to get even a single name of sometime. However you may consider the name of McDonald as they have own several properties across the world. But I am sure that you could be able to give me just 5 names of World’s Richest and famous Equity Investors, barring stock brokers, among the world’s top 50 richest billionaires. Some of them have become world’s richest by having own businesses in IT, Telecom, Retail, Casinos etc. But all of us would have interest to know the list of world’s richest people is made up primarily of equity investors. So, Warren Buffet, Peter Lynch, Benjamin Graham, Carl Icahn, Anthony Bolton and few others are so highly respected and popular equity investors across the world and ironically, no one a single investor into the list who built their wealth from property investment in billion dollars.

Internationally it is accepted that whosoever delivers 20% CAGR (Capital annual growth rate) or 20 years is a genius in equity investments. Warren Buffet has delivered 20% CAGR over 50 years and hence is the biggest name. If you take a look at the 18 year back, barring one, each one of them has delivered over 20% CAGR, average being 23% CAGR & highest being 28% CAGR. Even if they deliver zero return in next 2 years they would complete 20% CAGR for 20 years.

In short, we have so many Warren Buffets, Benjamin Grahams, Anthony Boltons in our country at our service, but normally Indians prefer investing in shares directly under the misconception that they will do a better job than Equity Fund Managers. Also, Indians prefer property and gold which results in low returns over long term.

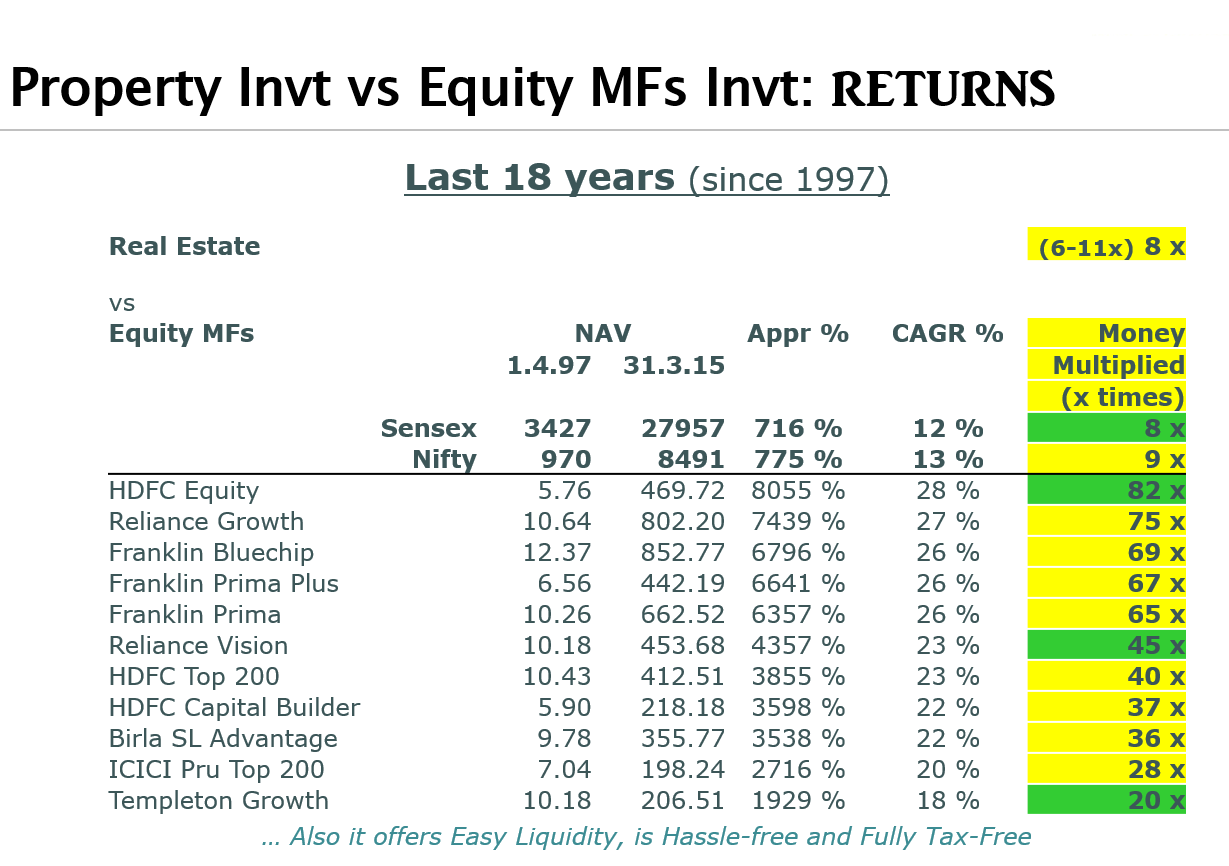

Property Investments Vs Equity MFs Investment: RETURNS

Let’s consider a savvy investor who invested in a fund with proper advice which has performed the best in last 18 years his money has multiplied 82 times. It means his 1 crore invested money in 18 years has grown to 82 crores today.

If someone would have invested blindly without any advice in any of the 3-4 available diversified equity funds at that time 18 years back, he would have got average kind of a return which is… his money has multiplied 45 times. He could have bought 5 flats in the same building where the person did property investment 18 years back and still has 5 crores left in his hand.

If someone who have invested in the worst fund which performed the least, even he is jumping with joy as his money has multiplied 20 times in 18 years.

Now, let’s have a serious look at the 18 year chart describes the returns on Equity MFs over Property Investments.

Source: BrainPoint Invesment Centre Pvt Ltd

In the above chart, these were the only open-ended funds available in 1997. Private Sector Equity Funds in India started in 1992, but if we take 1992 as a start year we would have only 1 fund for comparison. In 1997 we had at least 5 AMCs operating in India and at least 10 Equity Funds. Hence we have taken 1997 as the base year for the comparisons. The year 1997 is neither the peak of the market nor was the market at its bottom,

Maintenance and Tax Hiccups

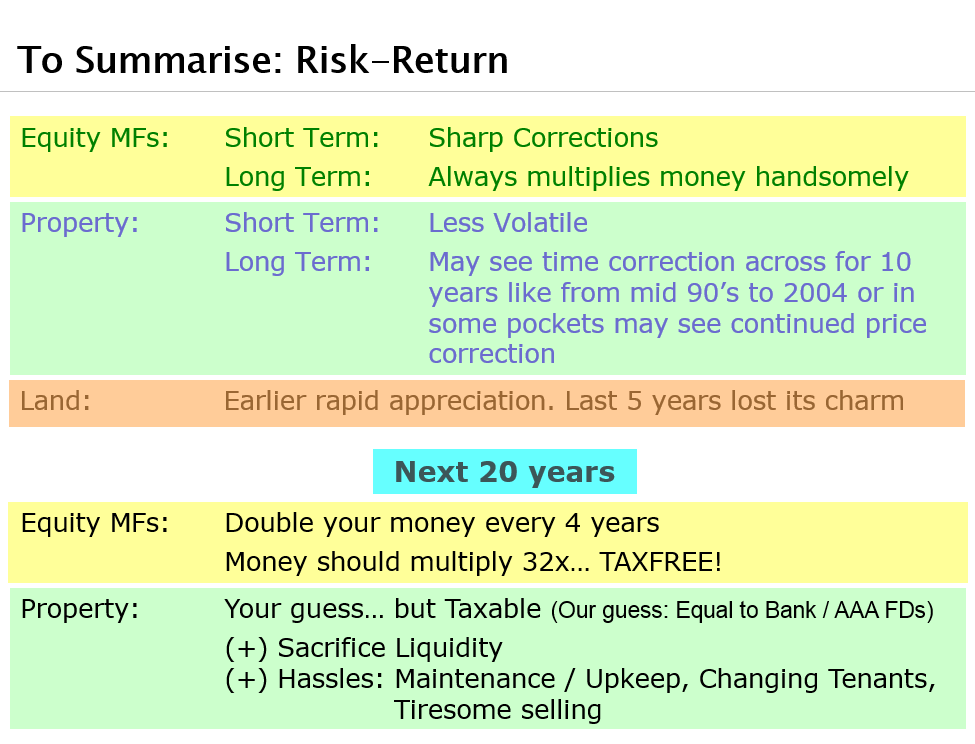

Since we have covered 2 economic cycles in 18 years, money has multiplied average 45 times in spite of all possible eventualities like Ketan Parekh scam, Kargil war, US Twin Tower attack, 2008 Global meltdown, Political fallouts etc. still the money has multiplied 45 times and also Equity MFs offer you easy liquidity, are absolutely hassle-free and are TAX-FREE too. Whereas in property investment, money has multiplied just 8 times , neither offers liquidity not is tax-free which is subject to capital gain tax and also comes with lots of hassles like upkeep / maintenance, changing tenants and also the selling is too tiresome. And the rent of around 2.5% pa of the property value is subject to 30% tax, you have to pay property tax, maintenance charges to the society, there is an upkeep cost etc. etc. which leaves hardly anything in your hand.

Still Confused?

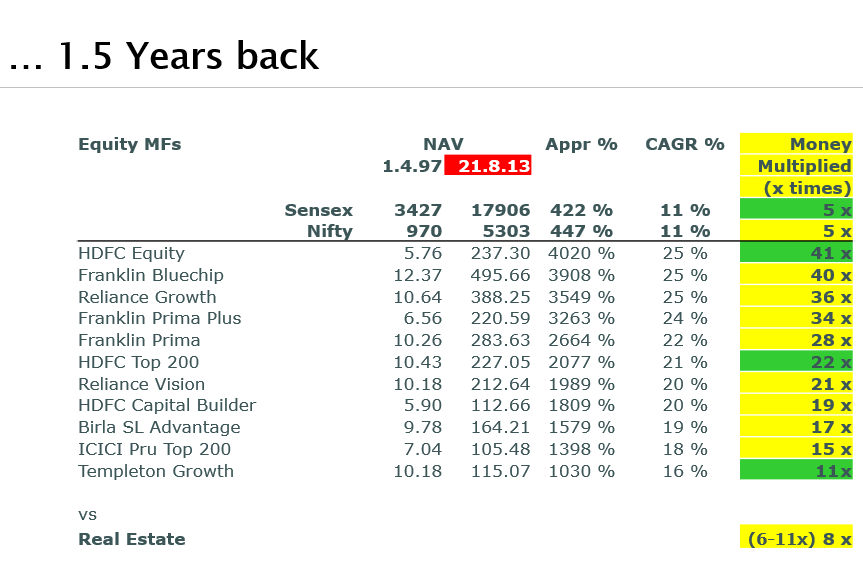

One may ask that the Equity markets have been rallying since the last 1.5 years, what if someone wanted the money when the markets were low? If we look at the same chart before the current rally started when NAVs were at the lowest in Aug 2013 during Equity crisis cum Debt crisis cum Currency crisis when USD had shot to Rs. 69… still if someone would have invested blindly without any advice in any of the 3-4 available diversified funds at that time in 1997, his money would also have multiplied 22 times. He would still have bought 2-3 flats in the same building where a property investor had bought a flat.

Source: BrainPoint Invesment Centre Pvt Ltd

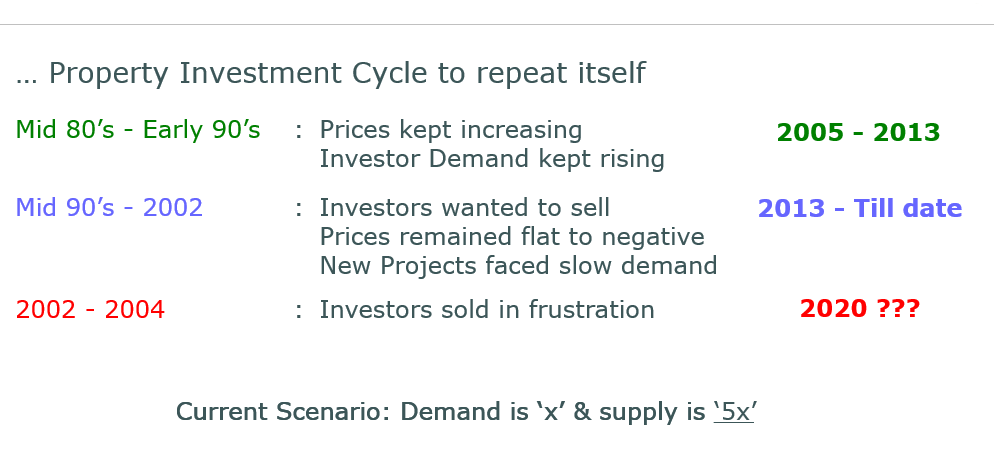

Investment Cycle

We are always bothered about price correction in equities and comfortably tend to forget huge time corrections in property. The price corrections in equity may last for 1/2/3 years but over any 10 year period in the past, the average money that has multiplied is at least 3-4 times in Equity MFs.

Temporary price corrections in equities are much more affordable than the 10-12 year period of time corrections that happen in property investments.

And now let’s look at the current property cycle…

Source: BrainPoint Invesment Centre Pvt Ltd

In last 2 years since 2013, the only buyers are the ones who are actually the end users who are buying the property for their personal use, whereas all the investors who have bought 2/3/4 properties have all turned sellers. Currently there is no demand from property investors per se. At some point of time in 2020 or by 2025 or by 2022, we don’t know when but there will be a stage when investors will be tired of seeing flat to negative prices for 5/7/10 years and will sell in frustration like they did during 2002 – 2004.

Conclusion

We can now like to conclude that every individual should go in for a Very BIG House which he can maximum but for personal use only, not for an investment. Also you should buy as much as gold jewelry as you wishes to wear, not for an investment. But for investment other than FDs, think only EQUITY MFs for, enjoying highest return, fully tax-free and anytime liquidity. Let the experts do the job for you.

Source: BrainPoint Invesment Centre Pvt Ltd

Save Time…Relax…And Earn More…

PS: This post is compiled by me where a veteran financial advisor shared his experiences at Wealthforum e-zine for the benefit of the entire advisory fraternity across the country to cope up the biggest challenges is to convince our clients that long term equity fund investment is superior to property investment.

Suresh Kumar Narula is founder and Principal Financial Planner at Prudent Financial Planners. He has earned the professional CERITIFIED FINANCIAL PLANNER and got registered with SEBI as Investment Advisor. He writes on personal and financial planning articles and got published in Dainik Bhaskar, Business Bhaskar and The Financial Planner’s Guild, India. He is also a member of Financial Planner’s Guild India ( An association of practicing SEBI registered Investment advisers) to create awareness about Financial Planning in general public, promote professional excellence and ensure high quality practice standards. Suresh received his an M.com from Himachal Pardesh University and an MFC from Punjab University, Chandigarh. He can be reached at info@prudentfp.in

invest Rs.10000/- per year in icici balance funds for 20 years you will get hand some

pool of fund the pention maximum rs.5000/- is less than 10% of your next expected maturity proceeds tax free also think invest in wise way, of course there is

guaranteed pention if Atal Pention Yojana holder died in between within 5 years the nominee will get pention of rs.5000/- on maturity of 60 years or immediately is not clear in the policy please share the details

To clear your anomaly, please read our post as http://www.sureshcfp.com/2015/05/atal-pension-yojana-is-not-looking-a-good-bet.html