Most investors take decisions based on market levels. If the markets are very high, they will wonder what to do and wait for some corrections. If markets are down, they still wonder what to do and still wait for another correction. They are so confused with the whole exercise of timing the market and it’s […]

Children Education Cost in Parenting Cycle!

For all parents, the greatest rejoice is the birth of first child. And, yet the chain of expenses associated with bringing up starts with the joy of a new baby on the way. In fact, starting with maternity, food, clothing, education, hobbies and health cares or entertainment to the caretaker costs, thus having a child […]

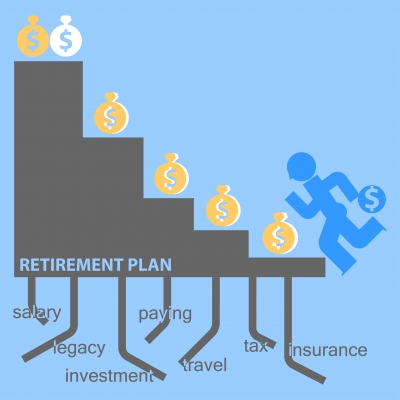

Have you estimated your Post-Retirement Expenses?

If you are selecting to read this article, your retirement countdown clock is ticking away. In your busy schedule, do you get to listen to it? If yes, what are you doing about it? Or if you are among those who take refuge in golden retirement myths like “I am too young to bother about […]

Avoid insurance Cover bundled with Home Loan

Nowadays, Housing finance companies and banks are mostly tied up with select insurance providers and bundled home loan products with home loan insurance plans. While taking home loan, on the act of surety, banks may push you to take home loan insurance plan for only those companies with whom they are tied up with. Furthermore, […]

MANAGING a Portfolio of Mutual Fund is the key

Assuming you had created a diversified slate of mutual fund holdings by putting the money in 5-star large-cap equity fund in the first place, with or without the assistance of a professional. You were not supposed to monitor your mutual fund investment regularly as you have been investing for long term, like a normal investor. […]

Are you Conservative Investor? Think Again

Many investors are pretend to be conservative but in reality they are aggressive in their investment life when they focus their investments in the same company or industry where they work and generate their income. For instance, a medical representative invests only in pharma stocks, a civil engineer concentrates on reality space and a software […]

Launch Yourself as CEO of your Financial Life!

Corporate creates wealth, thanks to the large number of employees who manage the different aspects of their operations. While the top management charts out the growth path and strategy, the marketing section creates and develops brands. The risk management arm works out ways to deal with risks. However, if you were to be the CEO […]

Is Your Bank really acted as a Financial Advisor?

We all trust our bankers blindly and always ride on bankers’ trust, apathy and ignorance. It is a common practice that banks access the financial information from their customer’s bank balances, fixed deposits etc. to target very specific customers who have large amounts of money at saving account or bank fixed deposits. They offer a […]