It has been worldwide accepted that equities are the best long-term asset class to generate the wealth over the decade. None of the all other asset classes are likely to outperform, if you stay invested in good equity funds for the long-term. Do you believe on these statements, if not, you are not alone as many investors could not been able to fully realize and internalize the eternal truth of this adage? Many investors whether rich or middle class, even highly educated still, often shun from equity investments. Perhaps, they are frightened from the daily volatility in stocks induced by market voices, can even shake off many investors who have already been holding stocks and funds for the long-term. This is the main reason, only a few investors could actually able to earn the sufficient returns from the market. However, there is another reason for investors not being able to realize the tremendous benefits of equities because of they are not fixed-income products. Comparing the rate of fixed deposit (FD) of bank with that rate of FD of company or corporate is very easy as their returns are fixed. But returns from mutual funds are so variable that it is not necessary that the same fund would be able to give same return in the different years as it may have to be in positive or negative periods. And therein lies the problem of how much we could get the return over the long-term.

Check Average Return

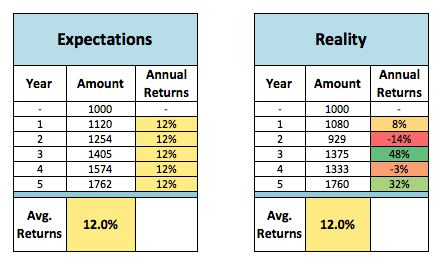

While taking stock of the mutual fund performance on www. Moneycontrol.com today, you will find all categories of equity funds sporting impressive returns. Many first-time investors tend to make mistake of jumping into equity funds after they’ve demonstrated impressive returns over one or three years. However, it should be safe to assume that, over a 10 year period, we can expect that equity funds can generate an annual average return of 12%. But it does not mean that you would get an annual return of 12% each year, it means that it is the calculated average over a period of time. The actual performance of your overall portfolio could be up 8% for a year, could be down 14% for the next year, followed by a 48% recovery for another year and eventually you would get an average return of 12% over the decade. One should not go for 1 year, 3 year and 5 year return rather than consider rolling returns or an average of multiple periods over the long-term. You should be rational one and should expect average returns which tell us nothing about the variance of actual returns that will occur.

Different Times give different returns

With the Sensex currently at a lifetime high after hurtling past 44,000, large-cap equity funds have delivered a 21 per cent return in one year and 16 per cent CAGR in five years. Multi-cap funds gave a 25 per cent one-year return and a 19 per cent CAGR for five years. Mid- and small-cap funds outperform five-year CAGRs of 25 and 29 per cent, respectively. If you look at the returns they are so good because the starting point for these computations is in 2012. Since we tend to invest based on our income levels, cash flows and financial goals, we do not have the luxury of timing it nicely to market lows. If you go in flashback to the subprime crises in 2008, large-cap equity funds have averaged a 6.01 per cent CAGR till date, beating the Nifty 50. Multi-cap funds have delivered an average 7.89 per cent CAGR. Midcap funds managed a 9.52 per cent CAGR till date and small-cap equity funds got to double digits at a 10.95 per cent CAGR. For another era, who invested in with lump sums in frothy market on 2000, the Nifty 50 has delivered a 10.33 per cent CAGR till date. Large-cap funds have earned 12.89 per cent; mid-cap funds, a healthy 16.3 per cent; and multi-cap funds, 14.53 per cent. But we must remember that these investors have had an extremely long 17-year period to bounce back from their initial losses. For the purpose of this analysis, we analysed the performance of all categories of equity funds from three previous occasions when the markets hit a new high before they came crashing down. So, given that all retail investors must give time their investment very carefully as time in the stock market matters more than timing the market.

Focus on successful schemes, not successful fund houses

There are large fund house and small fund houses. The successful fund houses that have grown big have done so mainly because of better performance. However, you need to be cautious while investing their schemes blindly. A fund house, with a few top-performing schemes, may also have a disappointing bottom schemes. You should be selective in fund schemes, not fund houses. Let us go back to the history of topper funds houses to understand this. You would notice that HDFC as an asset management company (AMC) dominates the top performers’ list in the large-cap category with two schemes in the top-3. However, within the same category, HDFC Large Cap Fund has been the third worst performer. Why is there is such a huge variation? This is not the only exceptional case. If one looks at the table of the multi-cap category, one will find Franklin India Focused Equity Fund in the top-5 and surprised to see Franklin India Opportunities in the bottom-5. Similarly, Birla Sun Life is another example. Birla Sun Life Frontline Equity was among the top-5 performers, but Birla Sun Life Opportunities is lagging at bottom five. While choosing schemes, don’t be influenced by how well other schemes of the fund house have done or how big the assets under management are. Our analysis suggests that such blind belief on successful fund houses can prove extremely injurious to your wealth. Had you invested in HDFC Top 200 funds had delivered 58 percent return and Franklin India Blue-chip Fund (51 percent) in 2008. But these toppers have backfired quite badly as the markets went into a tailspin and then climbed back. For investors who have held on till date, HDFC Top 200 at 9.9 per cent and Franklin Bluechip at 8.6 per cent have proved that no topper scheme from topper fund house could perform to own over the long-term. It needs to be periodically monitored and reviewed in every cycle of the market.

Cut-down your expectations

The lesson from these statistics is that drop down your return expectations to adjust for your high starting point. Today, even if your goal is three or five years away, you may be better off factoring a 10 per cent CAGR from equity funds rather than a 15 or 20 per cent CAGR. If you are lucky and your funds deliver much more, you will have the flexibility to cash out early. That’s much better than falling short of your goal after assuming an unrealistically high return. If you are going to invest at a new high, be aware that your portfolio may or may not deliver positive returns within one or three-year time frame. So it is wise to build a buffer for the fact that you might have to stretch your holding period by two or three years in the final set of your holding period to earn the expected return. The final lesson here is clearly that if your equity fund is outperforming its benchmark in a rising market and has a long-term record of delivering good returns; don’t switch it with a newbie fund just to kick up your portfolio returns. When investing at market highs, ignore one-year performance and keep your eyes trained on five- and 10-year rankings to select funds. How the fund contained losses in the previous bear phase may be more important for your choice than returns in the current rally.

PS: This post got published in Hindi Dainik Bhaskar on 27-06-2017

Suresh Kumar Narula is founder and Principal Financial Planner at Prudent Financial Planners. He has earned the professional CERITIFIED FINANCIAL PLANNER and got registered with SEBI as Investment Advisor. He writes on personal and financial planning articles and got published in Dainik Bhaskar, Business Bhaskar and The Financial Planner’s Guild, India. He is also a member of Financial Planner’s Guild India ( An association of practicing SEBI registered Investment advisers) to create awareness about Financial Planning in general public, promote professional excellence and ensure high quality practice standards. Suresh received his an M.com from Himachal Pardesh University and an MFC from Punjab University, Chandigarh. He can be reached at info@prudentfp.in