You must understand that the PPF account is a useful financial investment avenue that can really help you build wealth over the long term and tax saving tool as well. While investing in PPF, every Indian citizen enjoys its powerful benefits such as a decent rate of return, tax benefits, tax-free interest, loan against the account and tax-free maturity value. However it is important to note here that from a liquidity point of view, your funds are blocked in for 15 years. In such case, the major concern, for the most of investors is how to raise the necessary liquidity while remaining invested in their PPF account. In this post, you will learn an imaginative and innovative strategy of the ‘PPF Re-finance Plan’ which can meet your treble objectives, creating sizeable corpus, taking the benefit of the withdrawal facility before its maturity and availing of maximum benefit of deduction under section 80C of the Income-tax during the 15 year-term.

Premature withdrawal from PPF

Though the entire proceeds in your account could be withdrawn only on maturity, you could, however withdraw once a year, from the 7th year onwards, of an amount not exceeding 50% of the balance standing to your credit at the end of the 4th financial year immediately preceding the year of withdrawal or 50% of the balance at the end of the immediate preceding year, whichever is lower. Such withdrawal amounts would also not be repayable. To take this advantage, you have to just contribute to PPF for six years and can enjoy all benefits until its maturity.

We present the case study of Mr. Pal who is in the maximum tax bracket of 30.9% with income of Rs 10,00,000 and thus plans to avail of the deduction of Rs 46,350 under section 80C while investing of Rs 1,50,000 in PPF. His major concern, however, is the necessary to create liquidity of Rs 1,50,000 required for the purpose on an annual basis.

PPF Re-Finance Plan

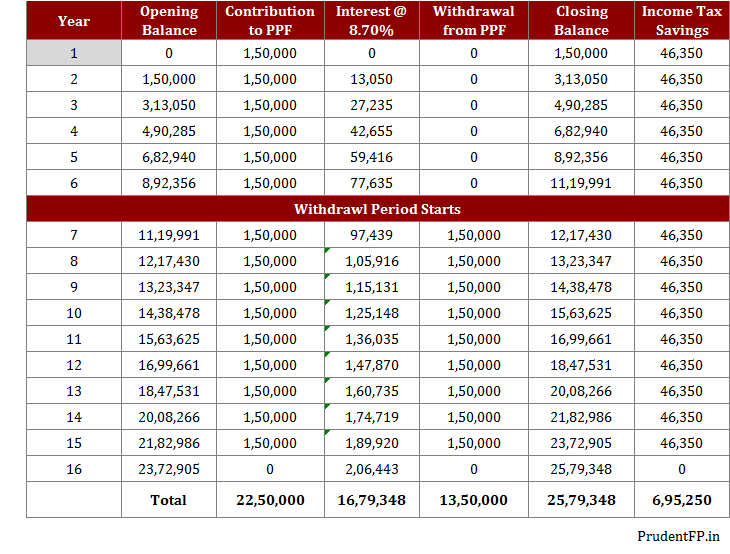

We at PrudentFP, advised to Mr. Pal should immediate open his PPF account and plan annual investment of Rs 1,50,000 out of his own resources for the first six years. From the seventh year onwards, he would be eligible to avail the benefit of the withdraw facility under which he is able to one withdrawal is permitted per year, of an amount not exceeding 50% of the balance standing to your credit at the end of the fourth financial year immediately preceding the year of withdrawal. Accordingly, Mr. Pal can plan withdrawals as shown in the table below from his PPF account up to Rs 1,50,000 every year so as to re-finance the necessary liquidity of Rs 1,50,000 needed for the annual investment of Rs 1,50,000 in the PPF account:

From the above table, you can see that Mr. Pal would be required to effectively contribute to his PPF account from his own resources for the first six years only. For the seventh year onwards, he would be entitled to draw Rs 1,50,000 (being within 50% of the balance in the account at the end of the third year). From the eighth year onwards, his total investment requirement of Rs 1,50,000 can be fully drawn by way of withdrawal from his PPF account. He can thus comfortably refinance the liquidity required for his PPF investment for the remaining years. To avail the benefit under section 80C, he should remain reinvest the same withdrawal amount of Rs 1,50,000 even on the same day with an annual income-tax savings of Rs 46,350 on the invested amount in the PPF account which would work out to Rs 6,95,200 during the 15-year PPF term.

Also you can see that Mr. Pal has total contributed to the PPF account during its 15-year term would be Rs 22,50,000, out of which Rs 13,50,000 would have been refinanced by withdrawals. So, the effective contribution out of Mr. Pal’s own resources would be only Rs 9,00,000. The interest of Rs 16,79,348 accruing in his account is totally exempt from income tax. Even after the withdrawal of Rs 13,50,000 from years 7 to 15, at the end of the 15-year term, Mr. Pal would be having a balance of Rs 25,79,348 to draw on closure of the account which could help his financial goals like a wedding in the family, further studies of his children, etc. Above all that it gives him a peace of mind as his money is safe.

To conclude, when choosing your tax saving avenue, be sure to choose according to your risk appetite. If you are a conservative to moderate investor, the PPF is a very good investment avenue. Even if you are an aggressive investor, the PPF can be a safe hedge against your more risky investments. Keep your liquidity needs, life goal time horizon and risk appetite in mind when investing.

Suresh Kumar Narula is founder and Principal Financial Planner at Prudent Financial Planners. He has earned the professional CERITIFIED FINANCIAL PLANNER and got registered with SEBI as Investment Advisor. He writes on personal and financial planning articles and got published in Dainik Bhaskar, Business Bhaskar and The Financial Planner’s Guild, India. He is also a member of Financial Planner’s Guild India ( An association of practicing SEBI registered Investment advisers) to create awareness about Financial Planning in general public, promote professional excellence and ensure high quality practice standards. Suresh received his an M.com from Himachal Pardesh University and an MFC from Punjab University, Chandigarh. He can be reached at info@prudentfp.in